An emergency fund is one of the most essential elements of a solid financial plan. It provides a safety net in case of unexpected expenses, such as medical bills, car repairs, or job loss. Without an emergency fund, you could find yourself relying on credit cards or loans, which can lead to debt and financial stress. Fortunately, building an emergency fund doesn’t have to be overwhelming. With a clear strategy and commitment, you can set up an emergency fund that provides peace of mind and financial security.

1. Understand Why You Need an Emergency Fund

Before diving into how to build an emergency fund, it’s important to understand why it’s necessary. Emergencies are unpredictable, but they are a certainty in life. A good emergency fund can:

- Cover unexpected expenses: Whether it’s a medical emergency, a car breakdown, or a sudden home repair, your emergency fund can handle these costs without derailing your budget.

- Protect your long-term goals: Having an emergency fund prevents you from dipping into savings meant for retirement, a home purchase, or other long-term goals.

- Reduce financial stress: Knowing that you have money set aside for emergencies can give you peace of mind, especially during uncertain times.

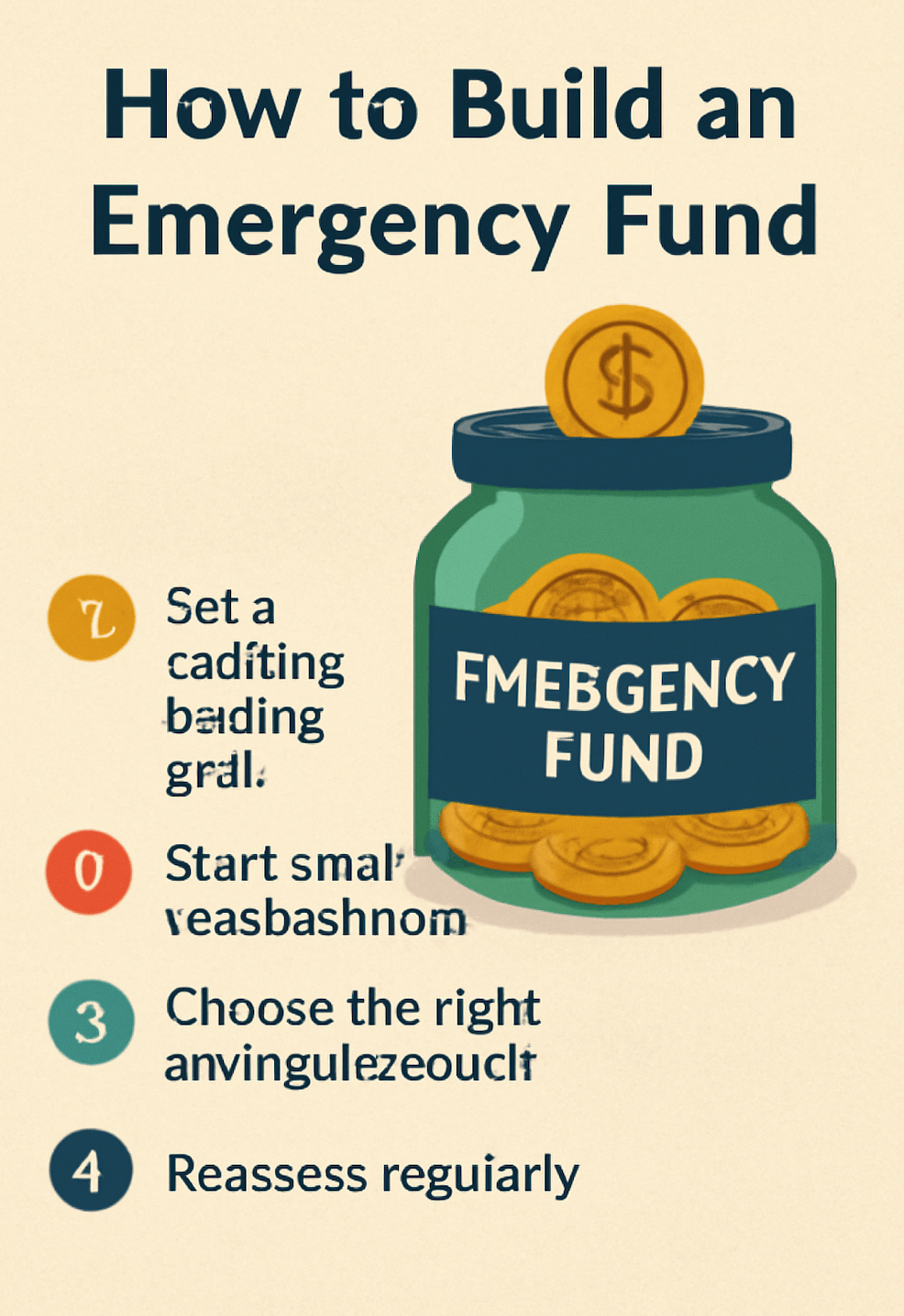

2. Set a Realistic Savings Goal

To build an effective emergency fund, you need to know how much you should aim to save. A good rule of thumb is to save enough to cover three to six months’ worth of living expenses. This amount varies based on your personal circumstances, such as:

- Family Size: If you have dependents, you might want a larger emergency fund to cover additional costs.

- Job Stability: If you have a more stable job or a side hustle, you might need less. However, if you work in an unstable industry or are self-employed, you may need more saved up.

- Location: Cost of living varies by location. If you live in an expensive city, you might need a larger emergency fund.

If saving three to six months’ worth of expenses feels daunting, start with smaller, achievable goals, such as saving $1,000 or covering one month’s worth of living expenses.

3. Start Small, But Start Now

One of the biggest challenges people face when building an emergency fund is getting started. It can feel overwhelming to save a large sum of money, but the key is to start small. Set aside a little money each week or month and gradually increase the amount as you get more comfortable.

Here are a few tips to help you start:

- Automate your savings: Set up an automatic transfer from your checking account to a savings account each payday. This makes saving effortless and ensures that you are regularly contributing to your fund.

- Cut unnecessary expenses: Look at your budget to see where you can cut back on non-essential spending. The money you save can be funneled directly into your emergency fund.

- Start with a small target: Begin by saving a few hundred dollars or aiming to cover one month of expenses. Once you achieve that, increase your goal.

4. Choose the Right Savings Account

When building an emergency fund, it’s essential to store your savings in an account that is easily accessible but still earns interest. While it’s tempting to keep your emergency fund in a regular checking account, this isn’t ideal because it might be too easy to dip into the money for non-emergencies.

Instead, consider the following:

- High-yield savings accounts: These accounts offer better interest rates than regular savings accounts, helping your money grow while keeping it easily accessible.

- Money market accounts: These accounts are similar to high-yield savings accounts but may offer even higher interest rates. However, they may come with more requirements, such as higher minimum balances.

- Online savings accounts: Many online banks offer competitive interest rates for savings accounts. Look for one with no monthly fees and a high interest rate.

Remember, the goal is to have quick access to the money in case of an emergency, but without making it too easy to spend.

5. Use Windfalls to Boost Your Fund

Whenever you receive unexpected money, such as a tax refund, bonus, or gift, consider putting it towards your emergency fund. Windfalls are a great way to jumpstart your savings and build your fund faster.

If you receive an extra $500, for example, put it into your emergency fund rather than spending it on a non-essential purchase. The more you contribute to your fund, the sooner you’ll reach your goal.

6. Reassess and Adjust Your Fund Over Time

Once you’ve built your emergency fund, it’s important to reassess it periodically. Your financial situation may change over time, so it’s important to adjust your savings goal accordingly.

Here are some situations where you might need to adjust your emergency fund:

- Job changes: If you switch to a less stable job or face job insecurity, consider increasing your emergency fund.

- Major life events: If you have a baby, buy a home, or take on other significant financial commitments, you may need a larger emergency fund.

- Lifestyle changes: If your expenses increase due to lifestyle changes, make sure your emergency fund reflects this.

7. Avoid Using Your Emergency Fund for Non-Emergencies

One of the biggest pitfalls when building an emergency fund is using it for non-emergencies. It’s tempting to dip into the fund for things like vacations or new gadgets, but this defeats the purpose of having an emergency fund in the first place.

To prevent this, make sure you define what constitutes an “emergency” clearly. Emergencies are typically unexpected expenses related to health, safety, or essential living needs. Non-emergencies, like shopping or entertainment, should not be covered by your emergency fund.

Conclusion: Build a Safety Net for Peace of Mind

Building an emergency fund may take time, but it’s worth the effort. By setting realistic goals, starting small, and sticking to your plan, you can create a financial safety net that will help protect you from unexpected expenses. An emergency fund provides peace of mind and ensures that you can navigate life’s challenges without derailing your financial stability.