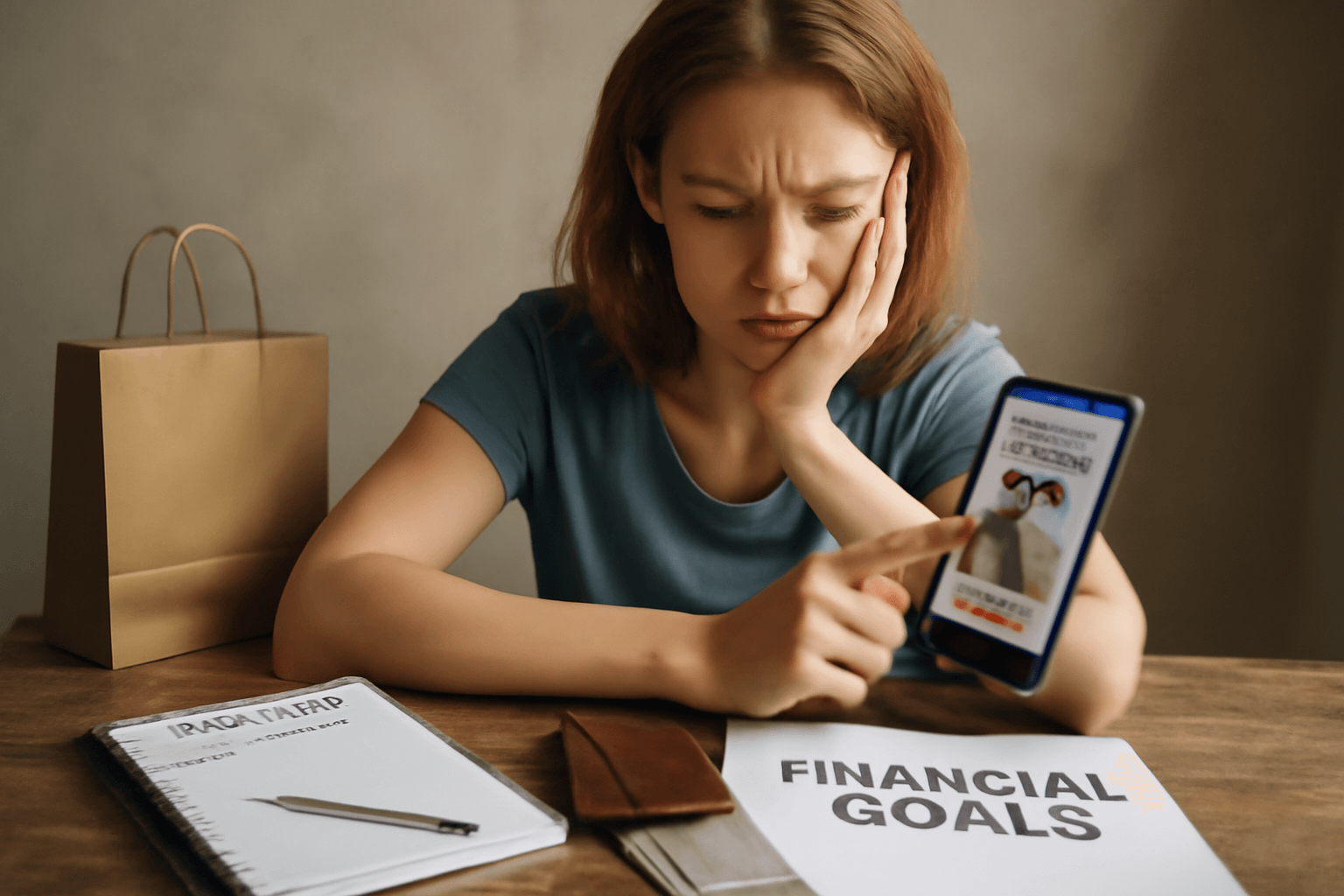

You walk into a store for toothpaste and walk out with snacks, candles, a new mug, and maybe even a sweater. Or maybe you scroll through your favorite online shop “just to look” and end up buying things you didn’t plan for. Sound familiar?

That’s impulse spending when you buy something on a whim, without planning or necessity. It happens to everyone, but over time, it can chip away at your budget, derail savings goals, and lead to buyer’s remorse.

This article is a guide for understanding impulse spending and learning how to curb it without shame, guilt, or extreme restrictions. We’ll explore the psychology behind impulsive purchases, and offer practical, mindset-based strategies for spending with intention.

What Is Impulse Spending?

Impulse spending refers to unplanned purchases made without much thought or consideration. They’re often triggered by:

- Emotions (boredom, stress, excitement)

- Sales and discounts

- Social media ads

- Peer pressure or comparison

- Immediate gratification

While some impulse purchases are harmless, repeated or large ones can result in overspending, debt accumulation, and reduced financial progress.

Why Do We Spend Impulsively?

To reduce impulse spending, it helps to understand the reasons behind it. Here are common psychological triggers:

1. Emotional States

Stress, anxiety, sadness, and even joy can influence spending. Buying something can feel like a quick “reward” or comfort—known as emotional spending.

2. Instant Gratification Culture

We live in a “buy now, get it tomorrow” world. With one click, we can purchase something without thinking twice. This convenience removes natural pauses that might help us reconsider.

3. Marketing and Scarcity Tactics

“Only 2 left in stock!”

“50% off—today only!”

These phrases trigger fear of missing out (FOMO), encouraging fast decisions that feel urgent.

4. Decision Fatigue

After a long day of choices, our mental energy depletes. We’re more likely to make poor financial decisions when tired or overwhelmed.

The Real Impact of Impulse Spending

Even if each purchase feels small, the cumulative effect can be significant. Imagine spending $25 impulsively every week:

- $25/week = $100/month

- $100/month = $1,200/year

That’s a vacation, emergency savings, or a new laptop gone without realizing it.

Impulse spending also affects mental health. Many people experience regret, guilt, or stress after unplanned purchases, especially if they lead to financial strain.

How to Identify Your Impulse Spending Habits

Start by observing your own behavior:

- Do you often buy items you didn’t plan for?

- Are your purchases tied to emotions?

- Do you buy because something is on sale even if you don’t need it?

- Are online shopping carts your go-to boredom cure?

Awareness is the first step. You can’t change a habit you don’t recognize.

10 Practical Ways to Curb Impulse Spending

Here are strategies you can start using today to reduce impulsive purchases and build healthier habits:

1. Use the 24-Hour Rule

If you see something you want to buy, wait 24 hours. Often, the desire fades, and you realize it wasn’t essential.

2. Set a “Spending Threshold”

Create a personal rule like:

“If it costs more than $50, I’ll wait 48 hours before buying.”

This pause creates space to think clearly.

3. Shop with a List—and Stick to It

Whether shopping online or in-store, having a list helps you stay focused. If it’s not on the list, don’t buy it.

4. Unsubscribe from Marketing Emails

Out of sight, out of mind. Remove temptation by unsubscribing from store newsletters and turning off shopping app notifications.

5. Track Your Spending

Use an app, spreadsheet, or notebook to write down every purchase. Seeing where your money goes can be eye-opening.

6. Identify Emotional Triggers

Notice what feelings lead you to spend. Instead of shopping, try alternative comforts like:

- Taking a walk

- Calling a friend

- Journaling

- Drinking tea or meditating

7. Set Financial Goals

Saving for a trip, emergency fund, or future investment? Let that goal motivate you to pause before buying.

Visual reminders like savings charts or digital dashboards can help.

8. Use Cash for Discretionary Spending

Try withdrawing a set amount of cash for non-essentials each week. When it’s gone, it’s gone. This can create natural boundaries.

9. Limit Browsing Time

Reduce time spent “just looking” on shopping sites. Use apps or browser extensions to block or limit time on certain sites.

10. Celebrate Non-Spending Wins

Did you skip buying something impulsive? Reward yourself without money. Acknowledge that decision as progress toward your bigger goals.

Build a Supportive Environment

Impulse spending thrives in environments full of temptation. Try creating surroundings that encourage better habits:

- Follow financial education accounts instead of shopping influencers

- Keep budget goals visible at home or on your phone

- Talk with friends or partners about shared saving goals

The people and media you interact with influence your choices more than you might think.

Final Thoughts: Progress Over Perfection

Everyone makes impulse purchases sometimes. The goal isn’t perfection it’s awareness and intention.

By recognizing your habits, setting clear limits, and aligning purchases with your values, you take control of your spending without guilt or deprivation.

Remember: every time you resist a purchase you don’t need, you’re saying “yes” to something more important. That’s financial power in action.