When starting your journey toward financial literacy, one of the most important terms you’ll encounter is “credit score.” Even if you’re not planning to borrow money right now, understanding your credit score is essential for building a strong financial foundation.

This article will explain what a credit score is, how it’s calculated, why it matters, and what you can do to understand it better all without giving any financial advice or specific recommendations. Our goal is to help you feel more confident and informed when managing your personal finances.

What Is a Credit Score?

A credit score is a three-digit number that reflects your creditworthiness or, more simply, how likely you are to repay borrowed money. It’s used by lenders, landlords, banks, and even some employers to assess risk.

Most credit scores range from 300 to 850, though different countries or regions may use different scoring models. The higher the score, the more “creditworthy” you appear in the eyes of lenders.

Why Does It Matter?

Your credit score can influence many aspects of your financial life, including:

- Loan approvals (for cars, homes, education)

- Credit card applications

- Interest rates you receive

- Rental applications

- Job screenings (in some industries)

In general, a higher credit score can make it easier and cheaper to access financial products and services.

Who Calculates Credit Scores?

Credit scores are typically generated by credit bureaus companies that collect and analyze information about your credit history. The three most well-known bureaus in the U.S. are:

- Equifax

- Experian

- TransUnion

In other countries, similar institutions operate credit scoring systems (e.g., Serasa in Brazil, Credit Karma in the UK and Canada).

Each bureau may have slightly different information, so your score can vary depending on the source.

What Factors Affect Your Credit Score?

While exact scoring formulas are proprietary, most credit scoring models use similar factors to determine your score. Here are the main ones:

1. Payment History (35% of score in many models)

Have you paid your bills on time? Missed or late payments can have a significant negative impact. Consistency is key.

2. Credit Utilization (30%)

This refers to how much of your available credit you’re using. For example, if you have a credit card with a $1,000 limit and your balance is $500, your utilization is 50%.

Experts often suggest keeping utilization below 30%, but the lower, the better.

3. Length of Credit History (15%)

How long you’ve had active credit accounts. A longer credit history usually improves your score, assuming it’s been managed responsibly.

4. Credit Mix (10%)

Having a mix of credit types (credit cards, loans, lines of credit) shows you can manage different kinds of borrowing.

5. New Credit Inquiries (10%)

When you apply for new credit, a “hard inquiry” may appear on your report. Too many hard inquiries in a short time can lower your score temporarily.

How Can You Check Your Credit Score?

In many countries, you’re legally entitled to access your credit report for free at least once per year. Some banks and financial institutions also provide free credit score checks to their customers.

Common options to check your score include:

- Official credit bureau websites

- Financial apps with score-monitoring features

- Government-sponsored financial literacy sites

Be cautious with services that ask for sensitive information or require payment to “unlock” your score. Stick with known, reputable sources.

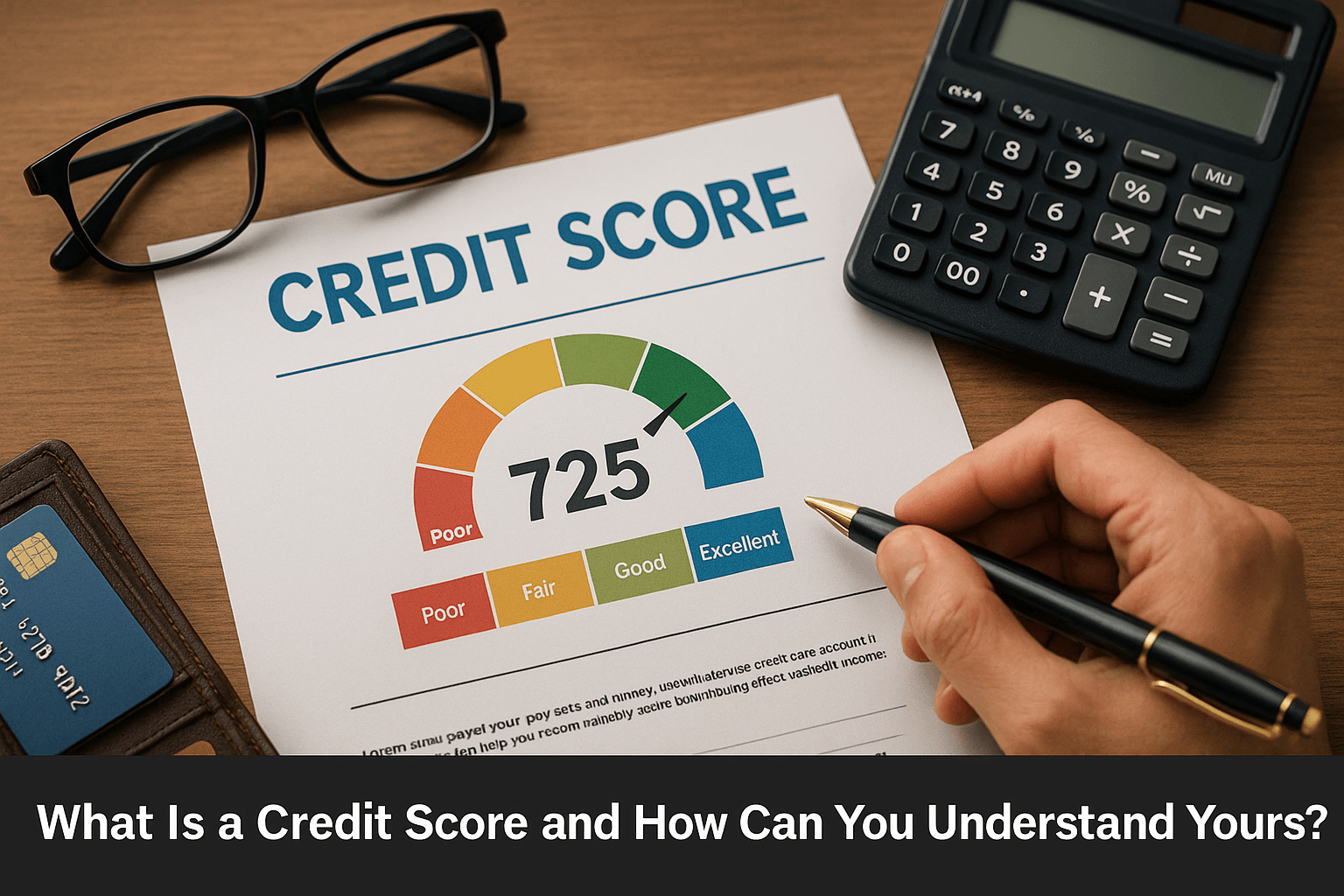

What Is a Good Credit Score?

Though scoring models vary, here’s a general breakdown of credit score ranges:

| Score Range | Rating |

|---|---|

| 800 – 850 | Excellent |

| 740 – 799 | Very Good |

| 670 – 739 | Good |

| 580 – 669 | Fair |

| 300 – 579 | Poor |

Again, these numbers are approximate and may differ depending on the country or scoring system being used.

Can Your Score Improve Over Time?

Yes. Your credit score is not fixed it can increase or decrease depending on how you manage your finances. Even if your score is currently low, understanding what affects it is the first step toward improvement.

Healthy habits that may influence score positively:

- Paying all bills on time

- Keeping credit card balances low

- Avoiding unnecessary hard inquiries

- Not closing old credit accounts unless necessary

It’s important to stay patient. Most improvements occur gradually over months or even years.

Common Myths About Credit Scores

Understanding your score also means avoiding common misunderstandings. Let’s debunk a few myths:

Myth 1: Checking your score lowers it

Fact: Checking your own score is a “soft inquiry” and does not affect your score. Only “hard inquiries” like applying for a loan or credit card may have a small impact.

Myth 2: You need to carry debt to have a good score

Fact: Using credit responsibly doesn’t mean being in debt. Paying off your balance every month is better than carrying interest-charging debt.

Myth 3: All credit scores are the same

Fact: You may have different scores depending on the bureau, the scoring model, and the purpose of the inquiry (mortgage vs. credit card).

How to Learn More Safely

If you’re just getting started, focus on education first. There are many free, reputable resources available:

- Financial education nonprofits

- Government financial literacy websites

- Free personal finance courses (e.g., Coursera, Khan Academy)

- Books like “Your Score” or “Credit Repair Kit for Dummies”

Be cautious with websites or services that claim they can instantly “fix” your score or remove accurate negative items—for a fee. These can often be scams or misleading.

Final Thoughts: Your Credit Score Is a Tool, Not an Identity

Your credit score is just a number it doesn’t define your worth or your intelligence. It’s a tool used to measure financial risk, and like any tool, it can be misunderstood or misused.

Understanding your score empowers you to make better financial decisions, ask the right questions, and avoid pitfalls. Even if you’re not planning to borrow money, having a healthy score can open doors and lower costs in unexpected ways.

The best time to start learning about your credit score is before you need it. The second-best time? Right now.