Achieving financial success isn’t about earning the most money it’s about managing what you already have with intention, discipline, and long-term thinking. Many people assume that wealth comes from luck, inheritance, or a high-paying job, but the truth is that most financially successful individuals have something in common: a consistent set of habits.

These habits aren’t complicated. They don’t require fancy tools or secret knowledge. Instead, they are small, repeatable actions practiced every day that lead to big results over time.

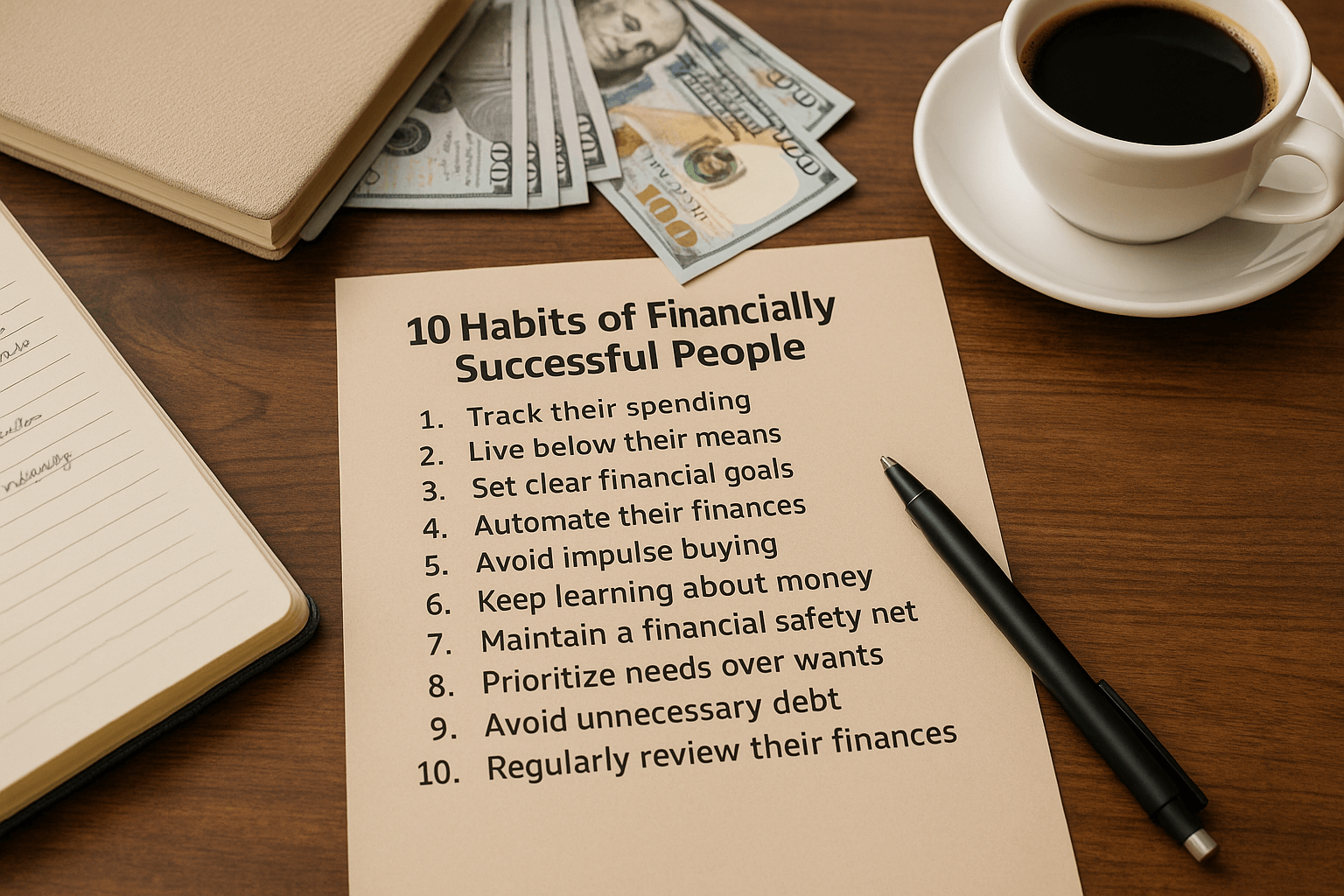

This article explores 10 fundamental habits that financially successful people tend to follow. This is not financial advice, but an educational look at the behaviors that can contribute to greater financial literacy and control.

1. They Track Their Spending in Detail

One of the most consistent behaviors among financially successful people is a strong awareness of where their money goes. This habit isn’t just about budgeting it’s about visibility. People who track their spending:

- Know how much they spend on fixed costs (rent, bills)

- Understand how much goes to variable expenses (groceries, entertainment)

- Identify leaks in their budget (subscriptions they forgot, excessive takeout, etc.)

Tracking tools range from manual spreadsheets to apps like Mint, YNAB, or PocketGuard. What matters isn’t how you do it, but that you do it consistently. This habit creates the foundation for all other financial decisions, because it brings clarity.

2. They Live Below Their Means—Consistently

It’s tempting to upgrade your lifestyle every time your income increases. A raise might lead to a new car, a bigger home, or more dining out. But financially successful people resist this urge. Instead, they:

- Maintain or modestly increase their spending when income grows

- Use excess income to save or invest

- Avoid the “lifestyle inflation” trap

Living below your means doesn’t mean deprivation—it means prioritizing long-term security over short-term indulgence. It’s one of the most powerful habits for creating lasting wealth.

3. They Set Specific, Measurable Goals

Without goals, it’s difficult to know where you’re going financially. Successful individuals often set goals that are:

- Specific: e.g., “Save $10,000 in 12 months”

- Measurable: progress can be tracked

- Time-bound: there’s a clear deadline

Examples of effective goals include:

- Paying off a credit card within 6 months

- Saving for a car down payment

- Building a 6-month emergency fund

- Reaching a certain net worth by age 40

These goals help prioritize spending and keep people focused during setbacks or distractions.

4. They Build and Maintain an Emergency Fund

Financial emergencies happen—unexpected medical bills, job loss, home repairs. Financially stable individuals are prepared. They maintain an emergency fund with 3 to 6 months’ worth of living expenses, stored in an easily accessible account like a savings account.

The benefits of this habit include:

- Reduced reliance on high-interest debt

- Peace of mind

- The ability to make thoughtful decisions during stressful times

Even if it takes years to build, having even a small emergency cushion can make a significant difference in financial security.

5. They Automate What They Can

Automation removes emotion and forgetfulness from money management. Many financially successful people automate:

- Bill payments to avoid late fees

- Savings transfers to make saving a default behavior

- Credit card payments to avoid interest charges

The principle is simple: make good financial behavior happen by default. Automating a $100 monthly transfer to a savings account, for example, ensures that saving doesn’t depend on remembering or feeling motivated.

Automation also helps prevent common mistakes like overspending money that was earmarked for another purpose.

6. They Continue Learning About Personal Finance

Money isn’t something most people are taught about in school, so successful people take learning into their own hands. They regularly engage with:

- Personal finance books and blogs

- Podcasts and YouTube channels

- Free online courses and webinars

The goal isn’t to become an expert—it’s to understand enough to make informed choices. They learn about:

- Budgeting and debt management

- How interest works

- Different financial products (bank accounts, insurance, retirement plans)

This knowledge helps people ask better questions, recognize red flags, and avoid bad financial decisions.

7. They Delay Gratification

The ability to wait for something better is a common trait in financially disciplined people. Instead of buying something impulsively, they practice habits like:

- The 24-hour rule: waiting a day before making a non-essential purchase

- Goal-based saving: setting aside money over time instead of financing

- Avoiding “buy now, pay later” options unless truly necessary

Delayed gratification leads to less debt, more appreciation, and smarter decision-making.

8. They Review and Adjust Regularly

Even the best financial plans need maintenance. Successful individuals often review their:

- Monthly expenses

- Budget categories

- Net worth (assets minus liabilities)

- Financial goals

This regular check-in could be weekly, monthly, or quarterly, but it ensures that their money is working in alignment with their goals. They adjust when needed, like cutting back during tight months or increasing savings during bonuses.

Without review, people tend to drift off course without realizing it.

9. They Avoid High-Interest Debt and Use Credit Wisely

Not all debt is harmful—some forms, like student loans or mortgages, may have a long-term benefit. But successful individuals are cautious with high-interest consumer debt, such as credit cards or payday loans.

They:

- Pay off their credit card balance in full each month

- Avoid borrowing for non-essential items

- Use credit to build history, not accumulate things

This habit helps preserve income for things that build wealth, instead of losing money to interest charges.

10. They Have a Long-Term Mindset

Financially stable individuals think beyond the next paycheck. They make decisions today with tomorrow in mind. This can include:

- Saving for retirement even in their 20s or 30s

- Making lifestyle choices that support sustainability

- Avoiding trends or hype-driven purchases

This mindset allows them to weather short-term losses for long-term gain. It also fosters patience, which is one of the most underrated financial virtues.

Building Your Own Financial Habits

You don’t need to adopt all ten habits at once. In fact, trying to do so may be overwhelming. Instead, choose one or two to begin with. For example:

- Start by tracking your expenses this week

- Set a small savings goal for the next 30 days

- Read one personal finance article per day

As these actions become routine, they’ll naturally reinforce one another and that’s when real change happens.

Why Habits Matter More Than Income

Plenty of people with high salaries live paycheck to paycheck. At the same time, many people with average incomes build strong savings, buy homes, and retire comfortably. The difference? Habits.

Income gives you the potential to build wealth. Habits are what make it happen. Good habits:

- Create stability

- Reduce stress

- Lead to better decisions over time

Financial success is much more about what you do than what you earn.

Final Thoughts: Small Steps, Big Impact

You don’t need to be perfect. Everyone makes financial mistakes. The goal is to make progress. Financially successful people weren’t born with special knowledge—they learned, tried, failed, and improved.

Start small. Be patient. Give yourself permission to learn as you go.

By adopting just one of these habits, you begin creating a foundation for financial security, freedom, and peace of mind.

And that’s a goal worth working toward one habit at a time.